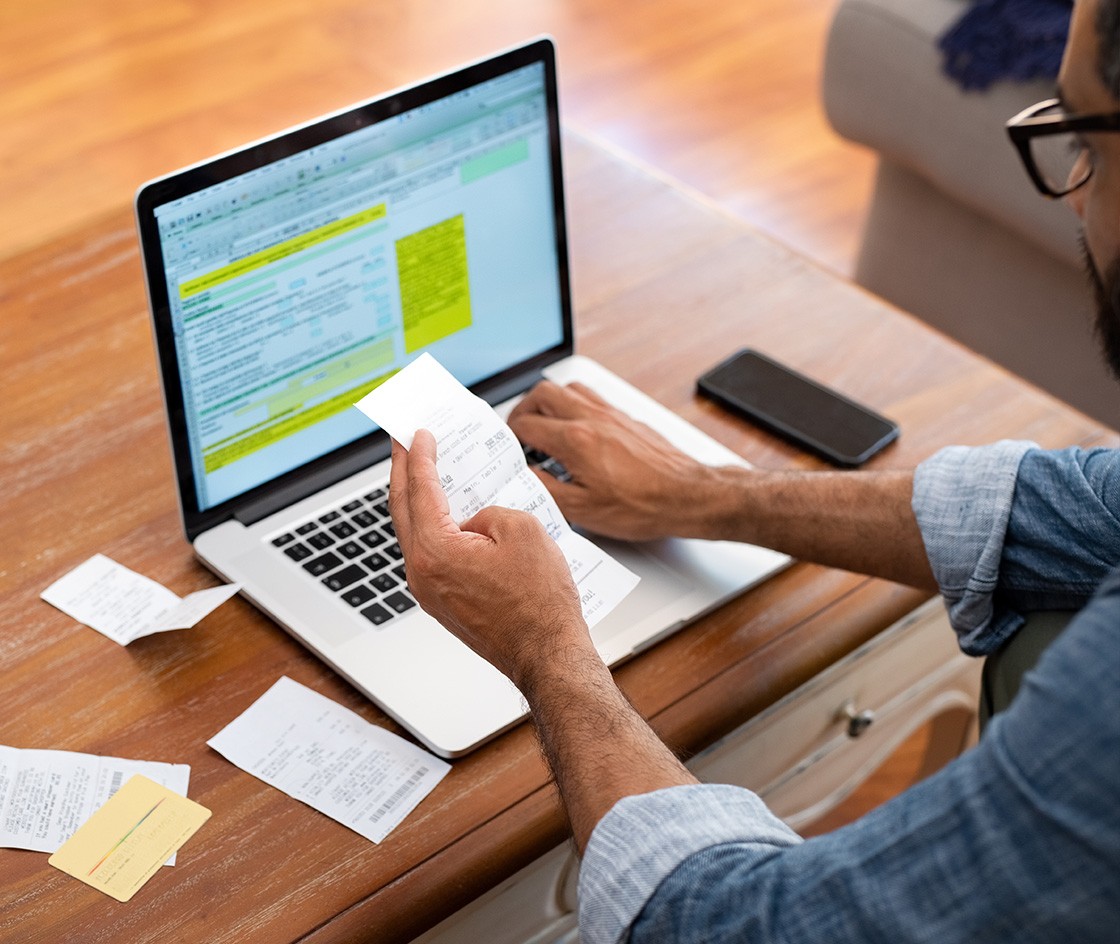

It is hard for everyone to manage expenses. Whether you make a manual spreadsheet or you some digital methods to track your expenses, you lose tracking them and end up being broke at the end of the month. This scenario is not the reality with those living paycheques to paycheque but with those who are earning a significant amount of money.

Well, if you are struggling to keep tabs on your expenses, you should use the software. These applications are not just meant for tracking personal costs but business expenses as well. If you are self-employed or running a small company, the software given below can help manage your expenses without causing trouble.

Quicken

Several features available at comparatively low cost are its unique selling point. Not just your personal expenses, this is a perfect solution for managing your business expenses. It helps with budgeting, saving goals, debt tracking, and managing investments. Excel exporting feature allows you to perform additional calculations.

You can set up payments for your bills, so you do not miss out on them. Want to know the net worth? You do not need to get statements from your accounting department as Quicken can do the accurate calculation of your net worth. Now knowing the real worth of your business is just as simple as anything.

It offers a 30-day money-back guarantee. Use this software to check if it meets your needs, and if you are overwhelmed with features, you can cancel the subscription. It is suitable for Android, Windows, iOS, and MacOS.

If you are looking to use all features, you can upgrade to a higher version at any time and take out unsecured bad credit personal loans if you do not have sufficient cash. You will have to buy Quicken Home and Business if you want to use it for your business expenses.

Rydoo

If you are looking for a system of paperless records of all your expenses, Rydoo is the best option. This is the best software application for small companies, including the self-employed. Now you can avoid reporting your expenses manually, and as a result, this helps save your time. You do not need to manually input figures into your computer.

You just need to upload the receipts through an app or your email. Then, the rest task is to be done by the app. For instance, you do not need to shuffle expenses to have them date-wise, as the app will do it on your own.

Further, it picks the most important data from receipts you upload, leaving out unnecessary information. The software can also categorise your expenses. If you have multiple branches, you can link them to their expenses so you can record the expenses of each branch in one place. The data will be saved digitally. However, if you want it for your own record, you can generate it in the form of XML, XLS, CSV, and PDF formats. You can get a free trial, and then you will have to subscribe for it.

Turbotax

Filing income tax returns seems to be a very monotonous task. How about filing it up within minutes? Yes, it is now possible with Turbotax. Step-by-step tax preparations with live support is its unique selling point. However, it is an expensive software tool. Whether you are to file your tax as a self-employed or as a director, you can use this software application at the time of filing a tax return.

This software cannot help manage personal or business expenses, but it comes in handy at the time of filing a tax return. It comes in a basic version as well, but it does not provide full access to all features. No free trial option is available, unlike Rydoo.

Expensify

This software application aims at managing all of your expenses without requiring your help. It means you do not need to embroil yourself into real-time accounting. It will keep your books up to date so you can focus on your other tasks.

This is not just exclusively suitable for business expenses. You can use this software app for personal expenses as well. Budgeting, saving, investing, debt management, and tracking expenses, you can do everything with this software.

Set reminders about bills so the due dates do not slip through the cracks. If you are using it for your business purpose, you can set reminders for bills to be paid, rental payments, or a payment of a business loan or a large debt like £10,000 loan for bad credit in the UK.

Personal Capital

This is the best software if you want to grow your wealth along with personal expenses. Its annual subscription can be higher than other software applications, but it helps manage all accounts in one place.

It can show your bank account transactions, debt accounts, and many more. If you have multiple accounts, you can link all of them to the software to get information on all accounts in one place.

You can maintain your investment portfolio using this software. You are eligible for personalised financial advice if your portfolio is worth over £100,000. The advice can come in handy regarding where you should invest and where you should not.

The app can also help with retirement planning. Using this software app, you will be able to track your regular expenses, investment portfolio, business expenses, and retirement savings.

The bottom line

You can use several other software solutions for personal and business expenses. However, some of them are free, but they will not be able to provide all benefits that the aforementioned software apps offer.

Investing in these software applications should not be a financial problem for you, even if you are a start-up or temporarily out of work. These software apps cover broader aspects of finances. Some of them will provide you with financial advice.

Now you no longer need to deal with financial problems as you can track all of your expenses with the help of software solutions. So when are you buying the one?

Description: Software solutions you can manage your expenses include but are not limited to Expensify, Personal Capital, Rydoo, Turbotax, and Quicken.